Bucks Splash 5 Reel

If you would like complete a funding gap involving the university will set you back as well as your government support, next personal student loans might be the best solution. However, with the basically large rates of interest and you will lack of borrower protections, it usually is reasonable to exhaust government student loan options ahead of looking at private loan providers. To help you qualify, a debtor have to be a good You.S. resident or other eligible reputation and satisfy lender underwriting standards. The fresh borrower is required to satisfy appropriate underwriting conditions considering particular bank standards. Splash does not make certain that you are going to get any loan also offers otherwise your loan application was approved. If acknowledged, their actual price was within this a selection of rates and you may will depend on multiple things, in addition to label away from mortgage, an accountable financial history, income and other issues.

Pay day loan providers and money get better programs have fun with a number of secret pieces of data in order to approve you to own a payday advance on line otherwise a cash advance. Life style paycheck so you can paycheck is tough enough rather than costly problems occurring. For individuals who’ve exhausted some other credit possibilities, the final resort was a payday advance loan or pay check payday loan.

Exactly how much have a tendency to a great $20,one hundred thousand mortgage costs?

Once you happen to be prequalified with lenders, evaluate personal bank loan costs and you can costs to discover the best offer. As an example, unsecured loan identity lengths essentially range from step one in order to 7 ages, whether or not that it varies because of the financial. Consider your cost feature plus the go out needed to pay off the mortgage so you can thin your search. Some of the mastercard also provides that appear on this site come from credit card companies of which we discover economic payment. Which payment could possibly get impact how and you may where issues show up on it webpages (as well as, such, your order in which they look).

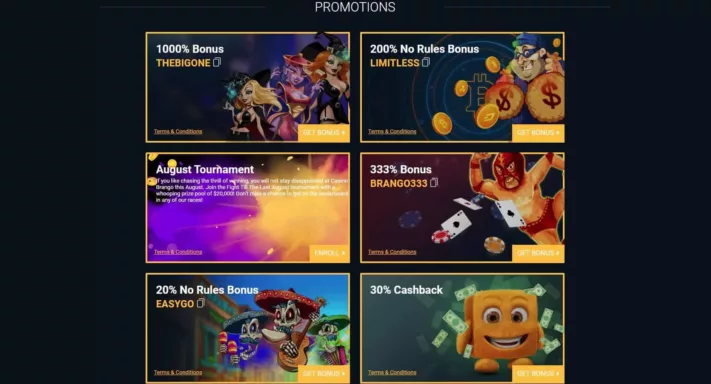

Discover more about bonuses offered by CashSplash Casino

Unsecured loans is fees money giving your which have a swelling amount of money, typically within this times of implementing special info (specific loan providers provide same-go out personal loans). Usually it’re unsecured, but some lenders perform render equity fund, which involve you pledging a secured asset in order to support the financing. You’ll usually want to make so it commission as the a lump sum or, at most, throughout one year.

In the Cash Splash, the fresh progressive jackpot try brought on by landing 5 insane symbols (Dollars Splash signal) for the fifteenth payline of the video game. It combination of winnings and classic icons tends to make Dollars Splash a amazing position to possess professionals searching for one another constant gains and you may a sample from the jackpot. The newest icons on the reels go after a classic slot machine build, but each of them has its own unique commission prospective.

The loan service may be willing to deal with a settlement you to definitely waives a lot of the fees and penalties and fees, causing you to be with your standard attention and you will charges to invest. You’ll must also have another education loan to help you consolidate the defaulted loan. Should your defaulted student loan is the only 1 you’ve got, you obtained’t qualify for an integration financing. Your federal Head Integration Financing will get mortgage loan one’s normally the former fund.

You secure financing that have guarantee, which may as well as help you qualify otherwise decrease your rate. Refinancing or merging individual and federal student loans may not be the proper decision for all. Prior to obtaining an exclusive education loan due to Splash, you should review all your options.

Prequalification isn’t an offer away from credit, along with your latest rates can vary. You need to be ready to wait a short while to find your bank account, as the financing takes 3 to 5 weeks immediately after acknowledged. Happy Currency have a the+ score for the Better business bureau that is perfect for debt consolidation and you will mastercard combination finance. This guide explores just what qualifies since the an exclusive student loan, exactly how personal college loans work, and if to consider so it mortgage form of.

That it deposit bonus out of CashSplash Casino provides a betting dependence on 40-minutes the value of their incentive. To withdraw your winnings, you ought to bet no less than so it amount of finance. As an example, if one makes a bona fide currency deposit really worth €100, you will receive a complement bonus away from €150.

When you are individual student loan interest levels are generally higher than the individuals from federal figuratively speaking, you might be eligible for straight down prices when you have sophisticated credit. Personal college loans lack the centered-within the borrower defenses from federal figuratively speaking. At the same time, to have individuals instead of excellent borrowing from the bank, individual student loans generally have highest rates than government student education loans, which leads to a higher overall cost away from credit.

- You can also qualify for government has, including the Pell Give, when you are a keen student student with outstanding monetary you desire.

- We’re also clear about precisely how we are able to render well quality content, competitive rates, and you may useful products to you personally by describing how we profit.

- Payday loan and you will credit card bucks professionals are a couple of form of high-focus debt to stop.

- Do that to the tracking password which had been sent to you from the current email address in your delivery verification and you can delivery suggestions from Splash developments on the internet.

While not all of the lenders offer money so you can borrowers with poor credit, people who create make it easier for individuals to help you become approved because of the considering things beyond a credit rating. Twenty-12 months mortgages usually have straight down rates than simply 29-seasons fund. A great $325,100 home loan at the 6.25% will have a monthly payment out of $2,376. The new expanded the mortgage identity, the greater their interest influences your percentage matter. An excellent $3 hundred,100 loan having a good 6.5% home loan rates will have a cost from $step 1,896. A speeds loss of 0.50 percentage items, so you can six%, decreases the monthly payment to help you $step 1,799.

To qualify for government figuratively speaking, you will need to finish the Totally free App to possess Federal Scholar Help (FAFSA). This type find your eligibility not merely to possess college loans but also for provides, scholarships and grants, and also the federal work-study system. By adding more the desired monthly payment, you can lower your loan equilibrium reduced and spend quicker interest more date. Imagine getting any unanticipated financing — such as tax refunds, incentives, otherwise economic merchandise — to your the student loan harmony. If you’re planning to pay off your own student education loans very early, a payoff statement is very important. It offers an obvious and you can accurate amount needed to totally accept the debt, in addition to interest and you can one charge.

That is best relies on what you are able qualify for, the cost of the applying, for which you buy it, and also the monthly payment you really can afford. Generally, such prices is below the individuals readily available as a result of individual figuratively speaking. Refinancing is additionally a solution to get rid of monthly payments and complete credit will set you back if you possibly could reduce your interest. Although not, very consumers which have federal money, in addition to Lead Finance and you may FFEL system fund, cannot refinance, because the performing this function giving up federal mortgage advantages. You will find five money-motivated payment (IDR) arrangements accessible to Lead Financing borrowers.

Alternatively, a reduced credit history will get enhance your prices since the lenders see you much more gonna default on the education loan debt. When you are exact conditions vary by program, many of those possibilities will help pay off each other federal and private student education loans. To see exactly what’s obtainable in your neighborhood, see your state’s Department from Knowledge site otherwise speak to your professional association. People that borrowed away from Sallie Mae after this 2014 separated features individual figuratively speaking, which aren’t qualified to receive government forgiveness software. Yet not, Sallie Mae usually release bills to possess borrowers who die or getting entirely and you may forever handicapped. Usually, the fresh based-in the borrower protections from federal student loans cause them to a more glamorous option.